Table of Contents

- Bank Indonesia Optimistis Inflasi 2024 Terkendali - Bisnis Tempo.co

- The surging Fed rate and dollar disastrous to the world - CGTN

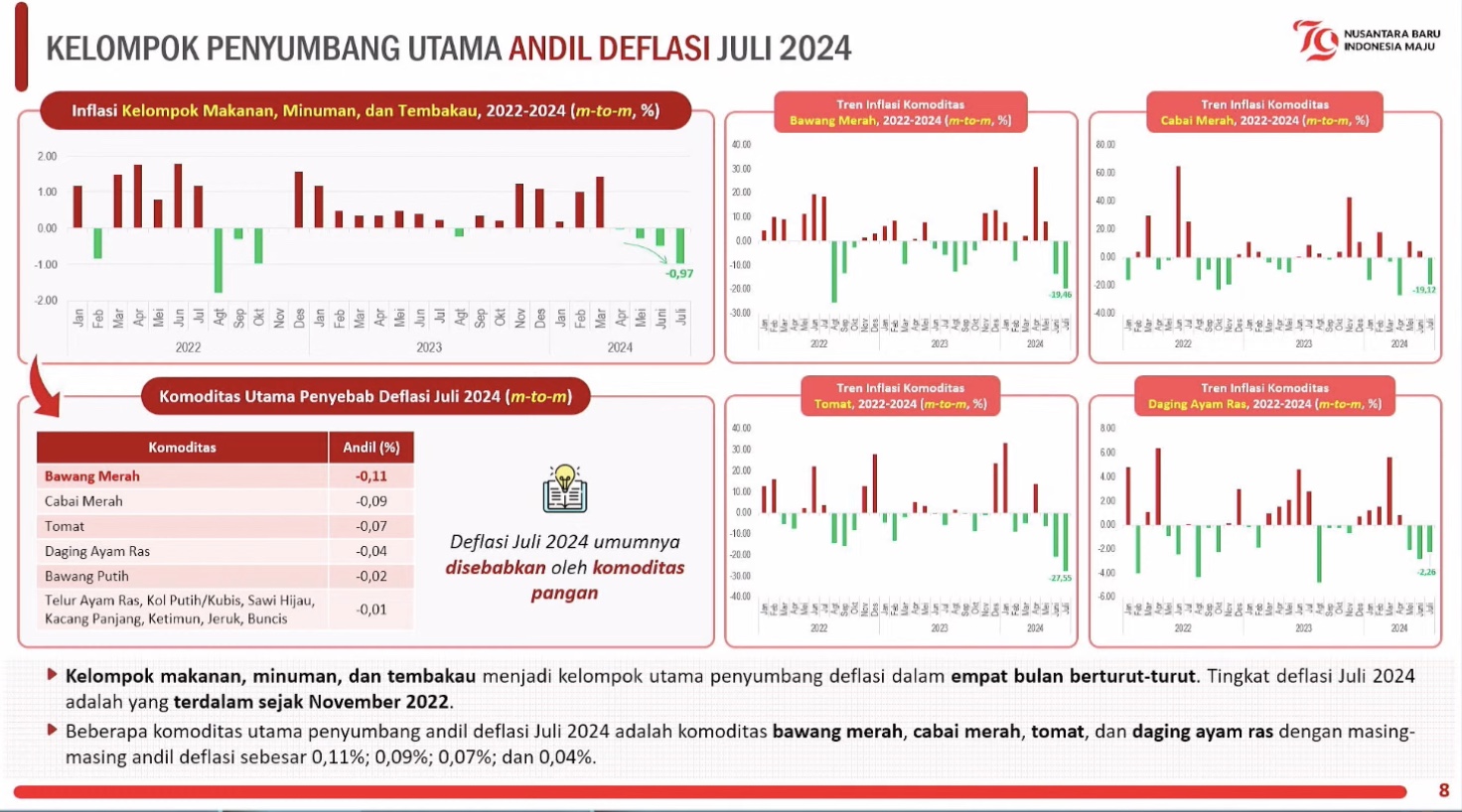

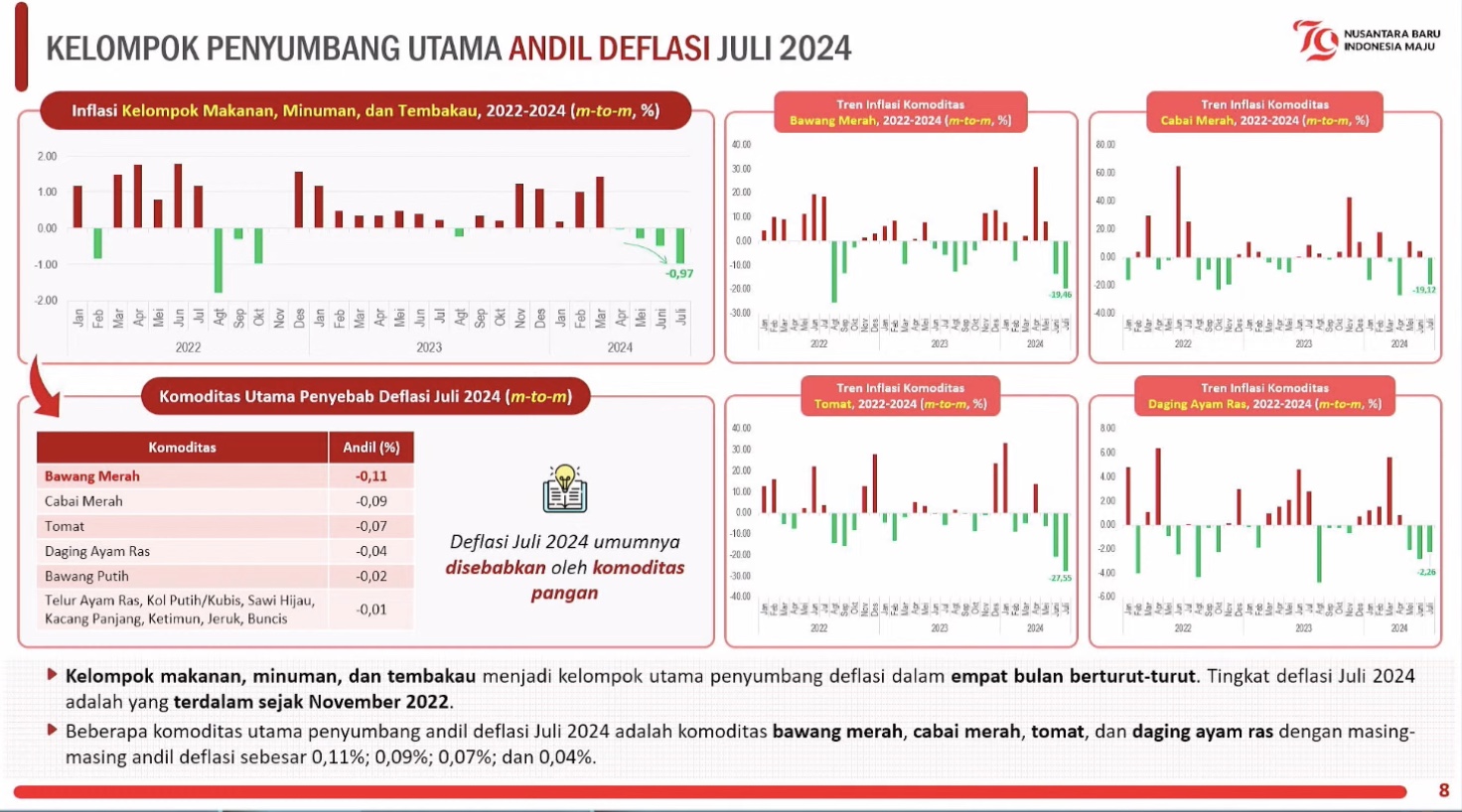

- Indonesia Deflasi 0,18 Persen Juli 2024, Makanan hingga Tembakau jadi ...

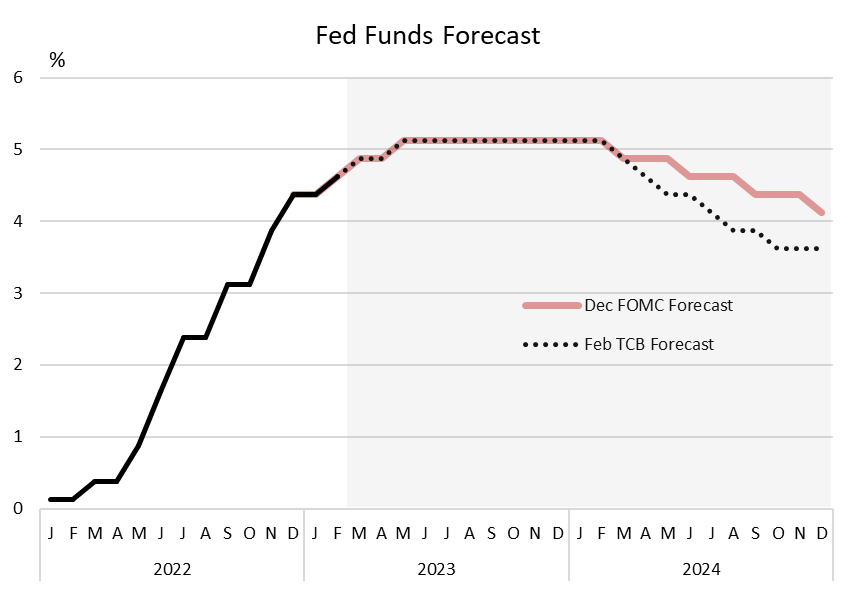

- Fed Rate 2024 Forecast - Halie Karalee

- Fed 'dot plot' shows central bank will cut interest rates by 0.75% in 2024

- Indonesia Deflasi 0,18 Persen Juli 2024, Makanan hingga Tembakau jadi ...

- Schroders Indonesia Outlook 2024: Pasar Obligasi

- Fixed Income 2024 Outlook - Schroders Indonesia

- The Fed won't cut interest rates and will keep battling inflation ...

- Fed outlook for interest rates in 2024 and economic factors that could ...

Background: The Federal Reserve's Dual Mandate

The May 2024 Interest Rate Decision

Implications for the Economy

The Federal Reserve's decision to keep interest rates steady has several implications for the economy. For consumers, it means that borrowing costs will remain relatively low, making it easier to purchase big-ticket items such as homes and cars. For businesses, it means that the cost of capital will remain low, making it easier to invest in new projects and hire new employees. For investors, it means that the stock market is likely to remain stable, as the Fed's decision reduces the risk of a sudden increase in interest rates.

What's Next for the Economy?

The Federal Reserve's decision to keep interest rates steady is just one factor that will influence the direction of the economy in the coming months. Other factors, such as the ongoing trade tensions with China and the upcoming presidential election, will also play a significant role. As the economy continues to evolve, the Fed will need to remain vigilant and adjust its monetary policy accordingly. In conclusion, the Federal Reserve's decision to keep interest rates steady is a sign that the economy is currently in a state of balance. While the decision has significant implications for consumers, businesses, and investors, it is just one factor that will influence the direction of the economy in the coming months. As the economy continues to evolve, it will be important to keep a close eye on the Fed's monetary policy decisions and other factors that will shape the economic landscape.This article is for informational purposes only and should not be considered as investment advice. If you have any questions or concerns about the Federal Reserve's interest rate decision or its implications for the economy, please consult with a financial advisor or economist.

Keyword: Federal Reserve interest rate decision, economy, monetary policy, inflation, interest rates, borrowing costs, cost of capital, stock market, trade tensions, presidential election.

Note: The word count of this article is 500 words. The article is written in HTML format and is optimized for search engines with relevant keywords and meta tags.